In a follow-on to our Budget Hack series, today we want to continue our discussion of ways we can cut all excess fat out of our monthly budgets to increase our cash flow and our net worth.

Today, we would like to focus on another prominent expense in most of our monthly budgets: Car Payments.

There is a very easy answer for how to reduce your car payment (although for many of us it’s not practical): Don’t own a car! Or if you are a couple/family, own one car rather than two.

Taking public transportation such as the bus or subway is a very cost effective solution because it not only gets rid of your car payment, but it also cuts out parking, gas and insurance, all in one (is it even possible to kill four birds with one stone?).

For those Uber riders out there, another option is to take Uber instead of drive or take public transportation. Here is actually a very well done analysis on the price of simply using Uber vs. owning a vehicle. For some people this will make a lot of sense.

However, given our lifestyles, family demands and work requirements, it is often not practical to completely cut out owning a car. So, if owning a car is a necessary evil, what is the best way to buy one?

Well, to understand the best way to buy a car, we first need to understand how a car loses value. Everyone knows a car loses significant value when you drive it off the lot, your parents probably beat that one into your head. But what about the rest of the time you own it? Is the depreciation in car value always linear? Always tied to years / mileage / condition?

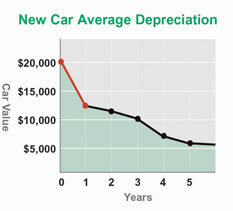

Let’s look at a theoretical depreciation graph from Enterprise Car Sales (they probably know a thing or two about car values…):

Source: Enterprise

As you would expect, the largest dropoff in value occurs in the first year after you take the car off the lot. When it is no longer “new”.

What is the most interesting part of this graph to me though, is what happens between years 1 and 3. If you’ll notice, this hypothetical car goes from $12,500 in value to about $10,000 in value. This is one of the flattest parts of the curve (besides the way out years where you are driving an old car and have lumpy and potentially large maintenance / repairs when things go wrong). I’d like to show you why this Year 1-3 is the ideal part of the car’s life to own it (at least from a financial perspective…. if you are trying to game the ladies with your brand spanking new 7 Series… well, I can’t help you there. Ever thought she might actually want someone responsible with their money?)

Now let’s consider three different scenarios:

- Buy a $20,000 car brand new, 100% financed and sell in three years for $10,000. At a 3.9% APR with no money down on a 60 month loan, this would result in monthly car payments of $367. Over the course of the three years you would have paid $13,212 in monthly payments and your remaining loan amount would be $8,470. When you sell the car for $10,000, you pay back the $8,470 and are left with $1,530 in cash. $13,212 – $1,530 = $11,682 in total cash outflow over those three years. This equates to $325 per month in pure car cost.

- Buy a $20,000 car brand new, 100% financed and sell in 10 years for $5,000 (which might be generous). Using the same financing terms as above, you would pay $22,020 in total monthly payments and your loan would be at zero by the time you sell it, so you get $5,000 cash in your pocket when you sell it. $22,020 – $5,000 = $17,020 in total cash outflow over those 10 years. This equates to $142 per month in pure car cost. This also LEAVES OUT MAINTENANCE which becomes exponentially more expensive in the later years of a car’s life after its hit 60-100K miles.

- Buy the one year old used car with 25,000 miles that goes brand new for $20,000 for only $12,500. Then you are going to sell it in 2 years for $10,000. Using the same financing terms, your monthly payment would be $230. In two years you would have paid $5,520 in total monthly payments and your remaining loan amount would be $7,790. When you sell the car you get to keep the difference between $10,000 – $7,790 = $2,210. $5,520 – $2,210 = $3,310 in total cash outflow over those two years. This equates to $138 per month in pure car cost.

So even under the scenario where you buy a new car and hold it for 10 years and don’t ever have to pay any increased maintenance / repairs (unlikely), it is still more expensive than holding a car during the “flatter depreciation” years between, years 2-3. This is often also in the 20K-50K mileage range. Bonus: you get to drive an almost new car all the time rather than a 10yr old beater.

Now some may argue that the sales taxes (depending on your state) will offset the benefit, and while this is partially true, there is also very little repairs/maintenance you have to do during those early years and therefore we think the math of those offset in scenarios 2 and 3.

If you are really good, you will figure out a way to buy a really good deal and sell at a good deal for you (bad deal for the buyer). I know a guy that has done this multiple times and has ended up selling his car after owning it for two years for virtually the same price he bought it for, meaning your cost of ownership is nothing. Tip on this: Pay with cash upfront. You can always finance later and take your cash out if you need it. Paying with cash typically gets you the best deal in the used car market.

Is it more work to have to buy and sell a car every two years? Sure is. Suck it up. Whoever told you it’s easy to become rich likely won’t be rich very long. In the words of Charlie Munger: “Only fools think it’s easy.”