Last week we discussed how examining the return on invested capital (ROIC) is one of the best ways to identify a great business.

The second thing we look at is the company’s operating margins relative to its peer group. Operating margin simply means how much money do they make on every dollar of sales?

Certain companies, like software companies, tend to have very high operating margins. Other companies, like grocery stores, tend to get by on razor thin margins, making pennies on every dollar.

In a bit of a twist, a higher operating margin does not automatically make something a better business. Many businesses, like Costco, make miniscule margins and yet still drive a very healthy return on invested capital (ROIC – which we discussed last week) by the sheer volume of their sales.

However, you can typically tell the best business in an industry by comparing the operating margins of a business to its competitors, i.e. its peer group. We call this company the “best of breed.”

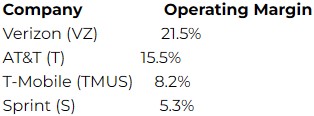

As an easy example, let’s look at the major wireless carriers:

That’s probably not surprising to most people, but by this test, it shows Verizon is the best of breed wireless carrier in the US.

Please note, this test doesn’t work when comparing across industries (breeds) though. Just because a tiny software company has higher operating margins than Verizon doesn’t mean it is a better business. The reason is because the underlying economics can be very different in different industries. The best operators will have better operating margins than the companies subject to the same types of business economics.

Over time, the best of breed companies tend to be able to better weather downturns and acquire weaker players during recessions, increasing their strength as a business.

Focus on finding high ROIC, best of breed businesses!

All the best,

Your Fortis Capital Management Team