Yesterday the S&P500 fell nearly 12% with the Dow and Russell 2000 falling even further. This was AFTER the Fed came out on Sunday with a $700 billion monetary stimulus program.

So, why did the market have its worst day since 1987’s Black Monday right after the Fed introduced a major quantitative easing plan? There may be a couple reasons:

- This confirms to investors that the economy is in really bad shape and the Fed is trying to do its part to support it. With restaurants totally empty, no traffic on the roads and everyone quarantined in their home we think people already have a sense of how bad it is. So why else would the selling accelerate after this move?

- Some folks think the Fed has fired all their bullets in the last few weeks and therefore has nothing else to combat the deterioration. We’d like to just come out and say this is FALSE.

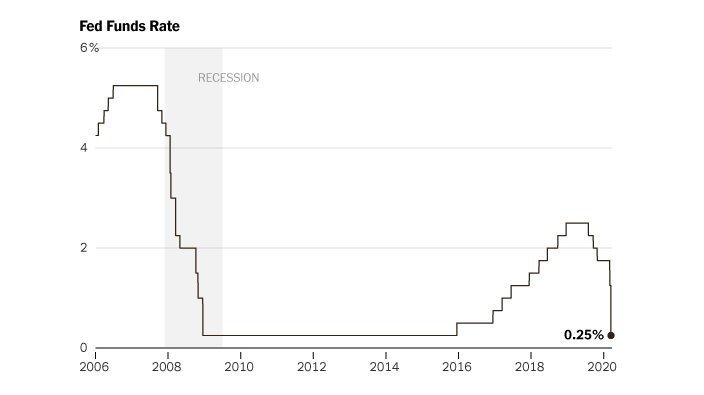

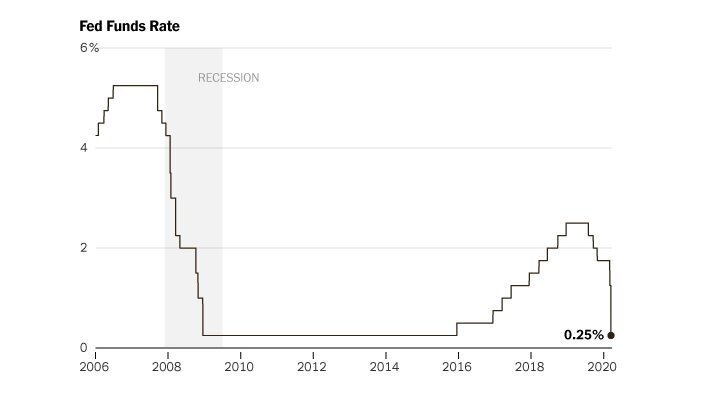

Here’s why. Many point to the fact that during the Great Financial Crisis (GFC) the Fed lowered rates from 4.5% to near zero and now we are already back to near zero so they have nothing left:

Source: New York Times

While this is true, this is not the only tool available to the Fed. The primary tool the Fed used to boost the economy over the last decade was “quantitative easing”, which is a fancy name for when the Federal Open Market Committee goes in and buys bonds in the market, primarily Treasuries and mortgage-backed securities. What this does is it lowers the benchmark interest rates banks use to lend as well as creates demand for mortgages at lower rates. Given that housing is an >$30 trillion industry, it’s important to keep people in their homes and low mortgage rates are one of the best ways to do that.

But again, the Fed said on Sunday they were going to use $500B to buy Treasuries and $200B to buy MBS, so what else can they do? Well, it’s worth remembering that during the GFC and the years thereafter, the Fed bought over $3.5 Trillion of Treasuries and mortgage-backed securities as you can see here:

Source: Reuters

So the $700B they have started with is no where near the level they used during the last recession. Additionally, it’s worth pointing out that the Fed has the ability to expand what it purchases. Next on the list would potentially be corporate bonds. This would lower interest rates for corporations and allow them to borrow money at lower rates. This would also provide liquidity for the fund managers with large bond portfolios who are facing redemptions and having to sell into a “no-bid market” at extreme prices.

Now, if they are going to buy bonds, do we think the Fed will get in and start buying equities as well? No. We are a very long way from them being that desperate. But it is not unprecedented. Japan has been buying equity ETFs for many years and its Central Bank is now the largest holder in a handful of the country’s largest ETFs:

Source: Zerohedge

For the doomsdayers who say the Fed can’t continue to print money and buy bonds because there is only so large a Central Bank’s balance sheet can get, we would respond “yes, that is probably true. But we are a long way from that. Look at the other major developed country Central Banks.”

Source: Legg Mason

In Summary – The Fed Has Plenty of Ammo, But What We Really Need is Fiscal Stimulus

We do not believe the Fed has used up all its bullets and if this crisis gets worse we will see them load up the ammo and pull the trigger (like they just did again today announcing they will purchase up to $1 trillion of short-term loans from corporations).

Instead of asking if the Fed has used up all its bullets, we need to be putting pressure on our politicians to institute fiscal stimulus. The market wants it and our country needs it. There are millions of real people who are going to lose their jobs and their businesses as a result of this shutdown and therefore the federal government needs to step in and support those families, businesses and industries. Many airlines will be bankrupt by the end of May if this continues and the government doesn’t intervene. Many restaurant owners, gym owners, etc. will lose their primary source of income. Hourly workers who can’t work will suffer. The government needs to pass a bazooka of a fiscal stimulus package to help the working-class Americans. And they need to do it fast.