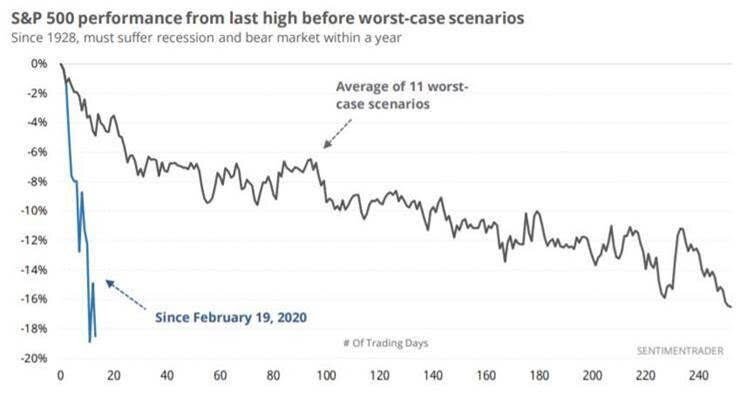

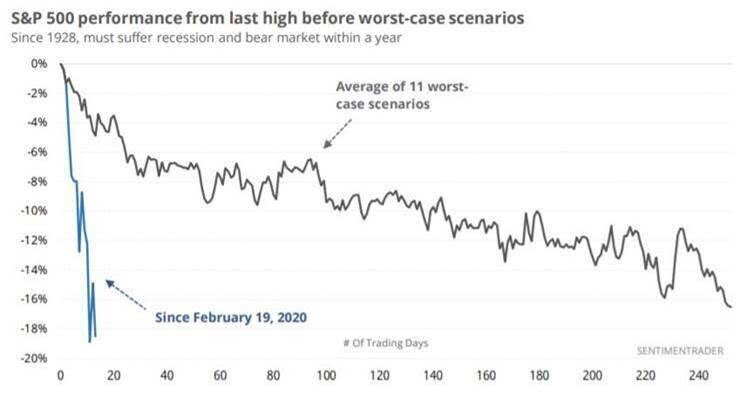

As of last Wednesday, (before the worst two days since 1987) the market selloff the past three weeks had been faster than any bear market in history, and it has only accelerated. In most bear markets, it takes over a year for the market to go down what we have dropped in the last 16 trading days. Of the 11 worst bear markets going back to 1928, here is an average of how they have performed vs. what this market has done through this week:

Source: SentimentTrader

We like to use historical data and statistics to inform how we think about the future, rather than emotions as emotions tend to be very misleading and ill-timed. For over a week now, the data has been showing extreme levels of short-term oversold conditions which, even in the midst of the worst bear markets, has led to multi-month rallies almost without fail. But so far that hasn’t happened.

The Market vs. the Economy

It is important to separate the economy from the markets. It is highly likely we will now see a recession in the economy. And the markets have priced this in with a 29% draw-down from all-time highs (for the S&P, even higher in small and mid-caps) which is already above the average draw-down for a recession.

We are going to be getting a lot of bad news shortly around the economy and health issues including (i) spikes in numbers of cases (likely already had it just finally tested), (ii) business closures, (iii) school closures (already happened in many states) and (iv) travel restrictions. However, the market is very forward looking and has already priced much of this in. The questions is whether the data is worse than what the market expects.

Pain and Panic Lead to Action

The more pain and panic we experience the more likely the Federal Government is to act aggressively to stop the bleeding. The Federal Reserve doesn’t want to experience another 2008. President Trump wants to get re-elected. Every major Central Bank around the world is easing and the more we go down the more likely it is officials come out with additional massive fiscal and monetary stimulus packages. The Fed and other central banks were too slow to act in 2008 and they regret it. The Fed didn’t lower rates from April 2008 to September 2008 despite Bear Stearns going under and significant underlying deterioration in the economy. The market bottomed in March 2009 when the Fed decided they would do “whatever it takes” to improve the liquidity situation. It is highly unlikely they let it get as bad before they act aggressively.

Additionally, the increase in bad news around the virus is going to be scary but is also most likely what stops the spread of it. Panic leads to people taking the appropriate action to contain it, despite the more challenging short-term economic consequences. As the panic levels rise (personally or in the market) we are all going to solve this problem by slowing the virus down.

Where We Go from Here

Markets generally only care about whether things are getting better or getting worse compared to expectations. Cases of this virus are going to explode as we test more but we will most likely level off the spread because of the panic that is setting in. When cases do finally level off, the markets will have the following going for them:

- Extreme oversold conditions

- Determined central banks willing to do almost anything necessary to kickstart the economy

- Determined governments willing to do anything necessary from a fiscal perspective

Just as there is a potential for more downside, we are going to get through this and when we do, the setup for the stock market could be quite positive.

What to Do Right Now

With all that being said, it is hard for any of us to sit idly by. We are doers by nature and want to problem solve. Here are a few things we can all do right now:

- Reassess Goals: It’s a good time to reassess one’s long-term goals to ensure there haven’t been any major changes as result of the disruption. When we can connect long-term goals/planning to short-term actions we tend to all make better decisions.

- Increase 401(k) and 529 Contributions: After aggressive selloffs like we have seen, one measured approach to patiently taking advantage of the panic is to increase 401(K) contributions and contributions to your kids’ 529 accounts. Personally, I (Mike) increased my kids’ 529 contributions from $200/mo to $400/mo last week. If the market drops another 10% I will increase them to $600/mo and then reduce them once we have recovered.

- Consider Gradually Investing Excess Cash: If you have excess cash you will not need for near-term expenditures in the next three years, consider gradually investing it. None of us are likely to call the bottom accurately, and the pain may continue or get worse before it gets better. But it will get better. Take a patient and gradual approach to putting cash to work.

As always, please reach out if you’d like to discuss in more detail. These are challenging times and we are working around the clock trying to ensure we do a good job serving our clients, so we are open to taking calls or virtual meetings as folks need.