US markets were volatile during Q3 but ended the quarter roughly where they started. Recent volatility has been driven by the debate in D.C. over raising the US debt ceiling and the market beginning to price in an eventual taper of the Fed’s bond purchase.

When the pandemic hit in March of 2020, the Federal Reserve was quick to open its 2008 playbook and began making roughly $120B in monthly bond purchases. This was made up of $80B in Treasury bonds, and $40B in mortgage-backed securities. The Board of Governors is now contemplating reducing those bond purchases by roughly $15B per month starting in November or December. However, exact timing and amounts have not been communicated yet.

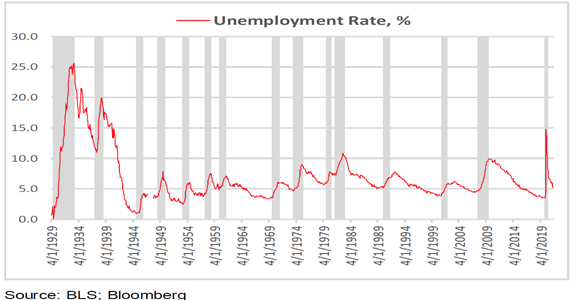

The Fed is trying to be transparent about their plan and provide the market with plenty of lead time before it takes any action. But it appears there is some internal disagreement at the Fed, and we can see why. On the one hand, particularly with the Delta variant spreading rapidly, we are very much still in the middle of a pandemic, which has hit the lower class the hardest and created tremendous political pressure to help the average American. On the other hand, unemployment rates, which skyrocketed in 2020, have dropped at the fastest pace ever after a recession. Unemployment is already lower than it was in 2013 when the Fed tapered its bond purchases after the last recession. If employment gains continue at their current pace, we will be at 2% unemployment by next June.

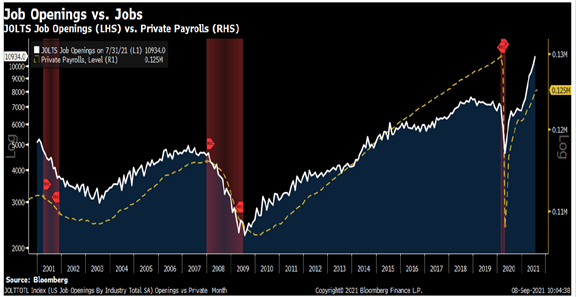

In addition, as you’ve probably seen at all your local stores, job openings are at record highs and employers are having a hard time filling their roles.

As part of the Fed’s dual mandate of full employment and stable prices, it is also closely watching inflation, which has, admittedly, been coming in higher than Fed Chairman Jerome Powell has expected.

It’s important to note, there are two types of inflation, demand driven and supply driven. Demand driven is strong economic performance that outpaces supply for a period of time. Demand driven inflation tends to be more product or sector specific and tends to cure itself as capitalism throws more supply at the problem. Supply driven inflation tends to come from specific shocks to a system like natural disasters or political crises (such as hurricanes, oil shocks, etc.). Once again capitalism tends to cure these by bringing on more supply over time.

What we have currently is a combination of the two as we had huge supply chain disruptions due to COVID coupled with a massive demand rebound driven by a strong fiscal stimulus policy that most suppliers did not/could not plan for. The impact of this has started to reverberate throughout the economy and push inflation up.

All of this data leads some Fed governors to conclude it’s time to cutback on the financial steroids. However, others are watching the recent spike in COVID cases and concerned about the country’s ability to fully re-open, not wanting to reduce accommodation preemptively.

The recent peak of COVID cases, the Fed’s discussion of tapering, and inflation being a bit more persistent than most had expected has caused the bond market to sell off the last six weeks and yields to rise across the board.

The evolution of the virus and the corresponding economic recovery will likely be the driving factor for yields going forward. Stronger economic growth will lead to higher yields. More shutdowns and subdued economic growth will lead to stable to lower yields.

Many of the stocks of high-growth technology companies benefitted in 2020 from a pull-forward of demand but have now been in long consolidation phases for much of the year. They’ve been “resting” after strong prior year performance but have also been feeling the pressure of higher interest rates (remember, the values of companies with stronger growth rates are more negatively impacted by higher rates). The poster child for this type of action here on our home turf is Amazon (AMZN), which is the exact same price it was a year ago:

The markets in 2021 have been led by “re-open” stocks such as hospitality, industrial and energy companies that benefit from the re-opening of the global economy in a post-COVID world. While we think it’s possible many of these cyclical companies have more room to run as the economy heats up, we are very bullish on high quality technology companies that have had meaningful corrections or consolidations over the last year and appear to be setting up for their next leg higher.

Disclaimer: The views and opinions expressed in this quarterly letter are those of Fortis Financial Group (“the firm”), which is a wholly owned subsidiary of Fortis Holdings LLC. Portions of this letter may contain certain statements relating to future results regarding companies we may invest in which are forward-looking statements. These statements are not historical facts, but instead represent only our belief regarding future events, many of which, by their nature, are inherently uncertain and outside of our control. Such forward-looking statements are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are subject to market, operating and economic risks and uncertainties that may cause our actual results in future periods to be materially different from any future performance suggested herein. Factors that may cause such differences include, among others: increased competition, increased costs, changes in general market conditions, changes in industry trends, changes in the regulatory environment, changes in loan relationships or sources of financing, changes in management, and changes in information systems and technology.

The firm will not publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or of which we hereafter become aware.

This letter should not be considered an offering or solicitation to invest with the firm. Ideas and views expressed within are not recommendations to buy or sell any securities. Past performance is not necessarily representative of future results. The investment strategy of the firm is not designed to resemble returns generated by the S&P500 or any other index mentioned herein, and strategy volatility may be materially different from that of the indices.