Medicare’s Income-Related Monthly Adjusted Amount (IRMAA) was implemented in 2003 alongside the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) which passed through congress that same year. While the provision has undergone a few notable changes throughout the years – namely, the introduction of income brackets in 2007 and the inclusion of Medicare Part D in 2011 – the core objective has remained the same: to right-size the cost of Medicare insurance for retirement aged individuals based on how much they can theoretically afford to pay.

Put simply, the IRMAA provision was introduced to adjust Medicare Part B (medical services and outpatient care) and Part D (prescription) premiums based on the qualified beneficiaries’ income levels. In other words, high-earning individuals and couples often find themselves required to pay higher premiums for their Medicare coverage compared to those in lower income brackets.

What Are the Four Parts of Medicare?

Medicare is effectively devised into two categories consisting of multiple parts: Original Medicare and Supplemental Medicare. Original Medicare is comprised of Medicare Part A and Part B and provides essential coverage for a range of medical services and treatments.

And changed What are the Different parts of medicare to What are the Four Parts of Medicare

Part A (Hospital Insurance)

Primarily covers inpatient hospital care and related services. Most people do not pay a premium for Part A insurance if they or their spouse have paid Medicare taxes while working.

Part B (Medical Insurance)

Focuses on outpatient care and medical services. A monthly premium, determined by one’s income level, is required to be paid by most Medicare beneficiaries. Learn about a valuable strategy to reduce insurance premiums here.

Supplemental Medicare includes Medicare Part C and Part D which provide additional coverage options for eligible beneficiaries.

Part C (Medicare Advantage)

Offered by private insurance companies and combines coverage from Part A and Part B. Those that opt for Part C coverage can also include additional benefits like dental, vision, and prescription drug coverage. It’s possible that opting for Part C coverage may offer potential savings relative to Original Medicare premiums, however, in-network coverage rules may limit available treatment options.

Part D (Prescription Drug Insurance)

Provides coverage for prescription medications through private insurance companies. Medicare beneficiaries have the option to choose a standalone Part D plan to supplement Original Medicare (Part A and Part B) coverage or select a Medicare Advantage plan (Part C) which includes prescription drug coverage.

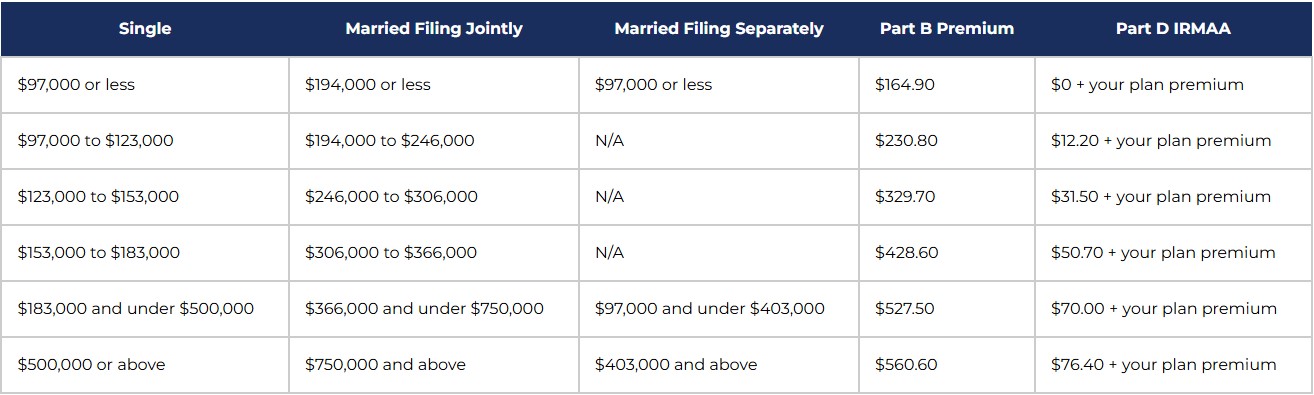

The 2023 IRMAA Bracket

Source: https://www.humana.com/medicare/medicare-resources/irmaa

As outlined in the chart above, individual beneficiaries enrolled in Medicare Part B and Part D are required to pay the IRMAA surcharge if they earn more than $97,000 a year (a minimum Part B premium is required for most Medicare beneficiaries, regardless of income level). This minimum threshold is variable and adjusted annually by the Centers for Medicare and Medicaid Services (CMS) in accordance with inflation. As such, this year’s mark of $97,000 represents a stark increase over 2022’s threshold of $91,000. This trend is anticipated to continue with Medicare advisory service providers expecting the minimum threshold to increase next year to $101,000 ($202,000 for married couples).

How Does the CMS Calculate IRMAA Surcharges?

The CMS determines annual IRMAA costs based on a beneficiary’s modified adjusted gross income (MAGI) from two years prior using reported gross earnings and tax-exempt interest less any eligible deductions. For the majority of individuals, these deductions will largely comprise of contributions to retirement accounts, though others may find they qualify to include things such as alimony payments and/or self-employed heath insurance, for example.

Three Moves to Reduce Your IRMAA Costs

- Increase your eligible deductions by contributing to a retirement account

- Whether this is a traditional IRA or a 401(k) plan, the more you’re able to contribute to these types of accounts now, the more you’re able to reduce your qualifying MAGI later.

- Open a Donor Advised Fund (DAF) for charitable giving

- Consider contributing cash or appreciated securities to a DAF and receive a tax deduction for the amount contributed.

- Reduce your tax liability

- Consider investing in more tax-efficient investments like Exchange-Traded Funds (ETFs) over more turnover-happy mutual funds to avoid excess capital gains which ultimately factor into your MAGI calculation.

How Best Should You Approach IRMAA?

Like most successful financial planning strategies, discussing your options and thinking ahead with a certified financial advisor is a good start. Interested in learning more? Connect with the team at Fortis Financial Group for a free, no obligation-required consultation