In the summer of 2025, Washington State became the most expensive state in the country for estate taxes. While there is no federal estate tax for individuals with a net worth under $15 million, residents in the greater Seattle area may find that a significant portion of their wealth will go to the state rather than their heirs.

For example, on an estate worth $5 million, Washington State may impose a tax of $250,000.

This tax was enacted to increase revenue for the Education Legacy Trust Fund, which funds smaller class sizes, teacher professional development, after-school programs, and financial aid for pre-K through higher education.

While supporting these programs may be appealing to some, there are legal strategies that allow you to distribute more of your estate to your heirs or a charity of your choosing. One of the simplest ways to achieve this can be through lifetime gifting. Because Washington State does not impose a state-level gift tax, you may be able to reduce your taxable estate before you pass away. This strategy applies to any estate value that does not exceed the federal lifetime exemption, which as of 2026 is $15 million per individual or $30 million per married couple.

For example, a person with a $10 million estate can give away $7 million during their lifetime, reducing their remaining estate to the $3 million exemption limit and avoiding Washington estate tax. The tax savings for this strategy are shown below.

The Math (New 2025 Rates)

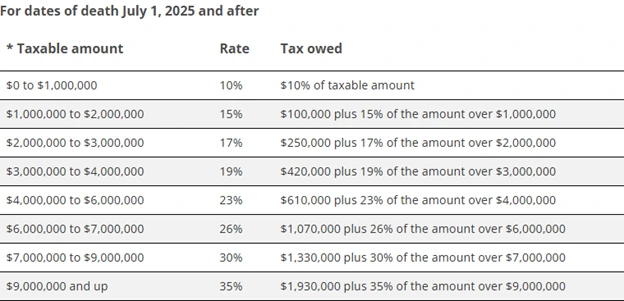

If an individual keeps all $10 million until death, the portion above the $3 million state exemption is subject to a progressive tax:

- Total Estate: $10,000,000

- Exemption Amount: $3,000,000

- Washington Taxable Estate: $7,000,000

Washington uses a graduated scale for the taxable portion:

- First $1,000,000: (10% rate) = $100,000

- Next $1,000,000: (15% rate) = $150,000

- Next $1,000,000: (17% rate) = $170,000

- Next $1,000,000: (19% rate) = $190,000

- Next $2,000,000: (23% rate) = $460,000

- Final $1,000,000: (26% rate) = $260,000

Total Washington Estate Tax Due: $1,330,000

By gifting the $7 million during their lifetime, the individual saves their heirs $1,330,000 in state taxes. Note that while Washington doesn’t tax these gifts, you must still file IRS Form 709 for any gift exceeding the annual federal exclusion ($19,000 in 2025 ).

Disclosure: This example is provided for illustrative and educational purposes only and is based on a hypothetical scenario, not an actual client experience. The figures shown assume specific facts, current Washington State estate tax thresholds, and tax rates in effect as of 2025, which are subject to change. Results will vary depending on individual circumstances, applicable laws, and future legislative changes.

This example does not represent a guarantee of tax savings or outcomes. Estate planning and gifting strategies involve complex legal and tax considerations, including potential federal gift and estate tax implications. While Washington State does not impose a gift tax, federal gift tax reporting requirements may apply, including the filing of IRS Form 709 for gifts exceeding the annual federal exclusion.

This information should not be construed as tax or legal advice. Individuals should consult with their tax and legal advisors to evaluate whether any strategy is appropriate for their specific situation. This example is not intended as a recommendation of any specific strategy and does not imply that similar results will be achieved.