For the ultra-wealthy, estate planning isn’t just about asset distribution; it’s about navigating complex tax laws to preserve wealth across generations. A Credit Shelter Trust, also known as a Bypass Trust or Family Trust, is an essential tool in this strategic process. By leveraging the federal estate tax exemption, this trust ensures that more of your wealth is transferred to your heirs, minimizing tax liabilities and maximizing financial legacy.

Understanding Credit Shelter Trusts

A Credit Shelter Trust is a type of irrevocable trust designed to make full use of the federal estate tax exemption. In 2024, the federal estate tax exemption is $13.61 million per individual. This means that an individual can transfer up to $13.61 million of their estate to their heirs without incurring any federal estate taxes.

However, for married couples, the combined exemption can be even more significant. When one spouse passes away, the Credit Shelter Trust allows their portion of the estate to be placed into a trust, utilizing their estate tax exemption while still providing income and limited access to the surviving spouse. The assets in the trust are not included in the surviving spouse’s taxable estate, thereby “sheltering” them from future estate taxes.

Practical Example

Consider a wealthy couple with a combined estate valued at $30 million. When the first spouse passes there is no estate tax because there is an unlimited marital deduction that allows the spouse to get all of the estate without estate taxes. Without a Credit Shelter Trust however, when the second spouse passes away the estate exceeding the individual federal exemption (i.e. everything above $13.61 million) could be subject to estate taxes upon the death. At the top federal estate tax rate of 40%, this could result in significant tax liability.

However, if the first spouse to die leaves $13.61 million in a Credit Shelter Trust, these assets are removed from the taxable estate when the second spouse passes. The surviving spouse can still benefit from the income generated by the trust, and the remaining estate can still use the surviving spouse’s exemption (up to $13.61 million). Thus, this strategy could potentially save the heirs millions in estate taxes.

Data Visualization

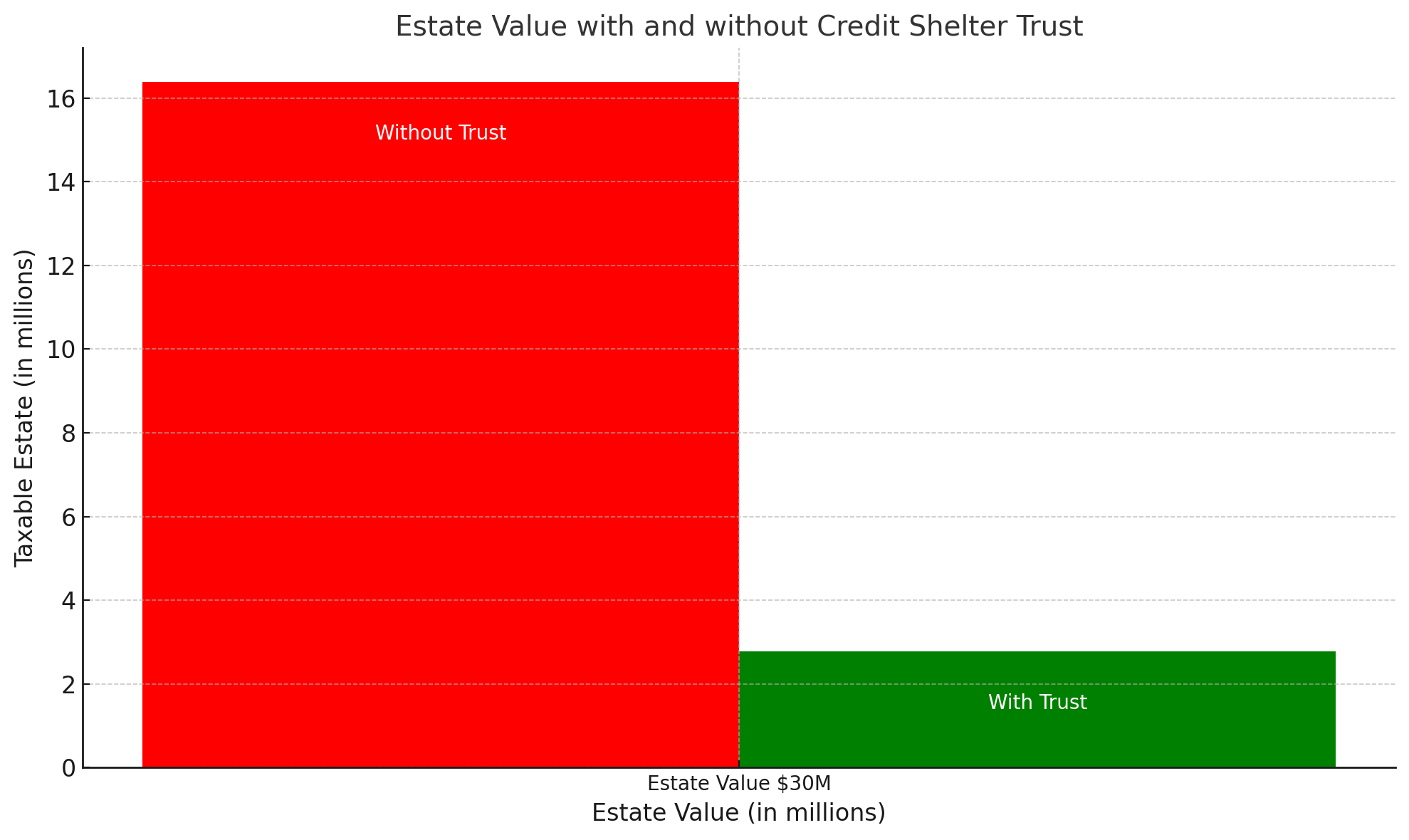

To illustrate the impact of a Credit Shelter Trust, consider the following charts:

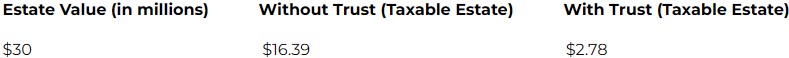

Chart 1: Estate Value with and without Credit Shelter Trust

This chart shows the difference in taxable estate value with and without a Credit Shelter Trust. By utilizing the trust, the taxable estate value is significantly reduced.

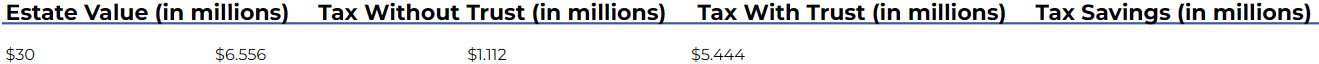

Chart 2: Potential Tax Savings

This chart illustrates the potential tax savings by implementing a Credit Shelter Trust. The savings are substantial, highlighting the effectiveness of this estate planning tool.

Advantages of Credit Shelter Trusts

- Maximizing Tax Exemptions: By fully utilizing the estate tax exemptions of both spouses, a Credit Shelter Trust can significantly reduce the estate’s tax liability.

- Income for Surviving Spouse: The surviving spouse can receive income generated by the trust, ensuring their financial stability while keeping the principal protected.

- Preservation of Wealth: The assets placed in the trust are protected from creditors and potential mismanagement, ensuring they are preserved for future generations.

Taxable Estate Value:

Potential Tax Savings

Implementing a Credit Shelter Trust

Setting up a Credit Shelter Trust requires careful planning and legal expertise. It is essential to work with experienced estate planners and financial advisors to ensure the trust is structured correctly and aligns with your overall estate planning goals.

At the Fortis Financial Group, we specialize in creating tailored estate planning strategies for the ultra-wealthy. Our team of experts collaborates with top legal professionals to design Credit Shelter Trusts that maximize tax benefits and preserve your wealth for future generations. We prioritize transparency and meticulous documentation to ensure compliance and peace of mind.

Conclusion

Credit Shelter Trusts are a vital tool in the estate planning toolkit for the ultra-wealthy. By effectively utilizing federal estate tax exemptions, these trusts can significantly reduce tax liabilities, provide for surviving spouses, and ensure the preservation of wealth across generations. At Fortis Financial Group, we are committed to helping you navigate these complex strategies with precision and expertise, ensuring your estate planning goals are achieved.

If you are interested in learning more and getting help with transferring assets to the next generation tax efficiently contact us today to setup a free consultation.